vehicle sales tax san antonio texas

Bexar County Tax Assessor-Collector Office. The sales tax for cars in Texas is 625 of the final sales price.

An Honest Comparison Of San Antonio Vs Dallas After Living In Both Cities For 10 Years Roaming Texas

San Antonio TX 78283-3950.

. 4 rows The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125. For example if a purchaser traded in a vehicle worth 15000 to a licensed dealer as part of the purchase of a 42000 vehicle. Box is strongly encouraged for all incoming mail.

You can find these fees further down on. SPV applies wherever you buy the vehicle in Texas or out of state. The San Antonio sales tax rate is.

4 rows San Antonio TX Sales Tax Rate. 2018 rates included for use while preparing your income tax deduction. The current total local sales tax rate in San Antonio.

San Antonio Sales Tax Rates for 2022. All Forms Tax Vehicle Property Taxes - Applications and Forms. Please allow up to 15 days for the processing of your new window sticker or new plates by mail.

Reach Out to QQ Online Portal and subscribe for the most efficient method of complying with all the new nexus interstate tax laws. The County sales tax rate is. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

Texas Motor Vehicle Sales Tax Motor vehicle sales or use tax is due by the 20th day of the month following the purchase use. Some dealerships may charge a documentary fee of 125 dollars. The Texas sales tax rate is currently.

Box 839950 San Antonio TX. This rate includes any state county city and local sales taxes. You can calculate out-of-state rates tag title and other fees based on the client post code.

Access business information offers and more - THE REAL YELLOW PAGES. The minimum combined 2022 sales tax rate for San Antonio Texas is. If you purchased the car in a private sale you may be taxed on the purchase price or the standard presumptive value SPV of the car whichever is higher.

1000 City of San Antonio. The latest sales tax rate for San Antonio TX. Compare Sales Tax Attorney in San Antonio TX.

Public Sale of Property PDF Bidder Request Form PDF Property Tax Frequently Asked Questions. What is the sales tax rate in San Antonio Texas. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

City of San Antonio Attn. The Texas Comptroller statesthat payment of motor vehicle sales taxes has to be sent to the local countys tax assessor-collector. Texas collects a 625 state sales tax rate on the purchase of all vehicles.

A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. 100 Dolorosa San Antonio TX 78205 Phone. The State of Texas imposes a motor vehicle sales and use tax of 625 of the purchase price on new vehicles and 80 of the Standard Presumptive Value non dealer sales of used vehicles.

County tax assessor-collector offices provide most vehicle title and registration services including. Hours Monday - Friday 745 am - 430 pm. Sell Or Trade A Car.

Home Used Cars in San Antonio TX. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Registration Renewals License Plates and Registration Stickers.

0250 San Antonio ATD Advanced Transportation District. For retail sales of new and used motor vehicles involving licensed motor vehicle dealers the motor vehicle sales tax is based on the sales price less any amount given for trade-in vehicle s andor dealer discounts. San Antonio TX 78205.

Did South Dakota v. Debit Credit Fee 2 BikeReg is just that Lg Apk Font According to state law Texas drivers need to have minimum insurance coverages of 30000 per injured person up to at least 60000 per accident Complete a Request for Texas Motor Vehicle Information Form VTR-275 for crimes that occurred in November at The Grove at San Marcos 1150 E. City of San Antonio Print Mail Center Attn.

0125 dedicated to the City of San Antonio Ready to Work Program. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value. San Antonio TX 78207.

You can find more tax rates and allowances for. Send your renewal form and a photocopy of proof of insurance to. This is the total of state county and city sales tax rates.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. San Antonios current sales tax rate is 8250 and is distributed as follows. What is the new car sales tax in San Antonio Texas.

PersonDepartment 100 W. Mailing Address The Citys PO. In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees.

Vehicle registrations may also be renewed by mail. A vehicles SPV is its worth based on similar sales in the Texas region. PersonDepartment PO Box 839966 San Antonio TX 78283-3966.

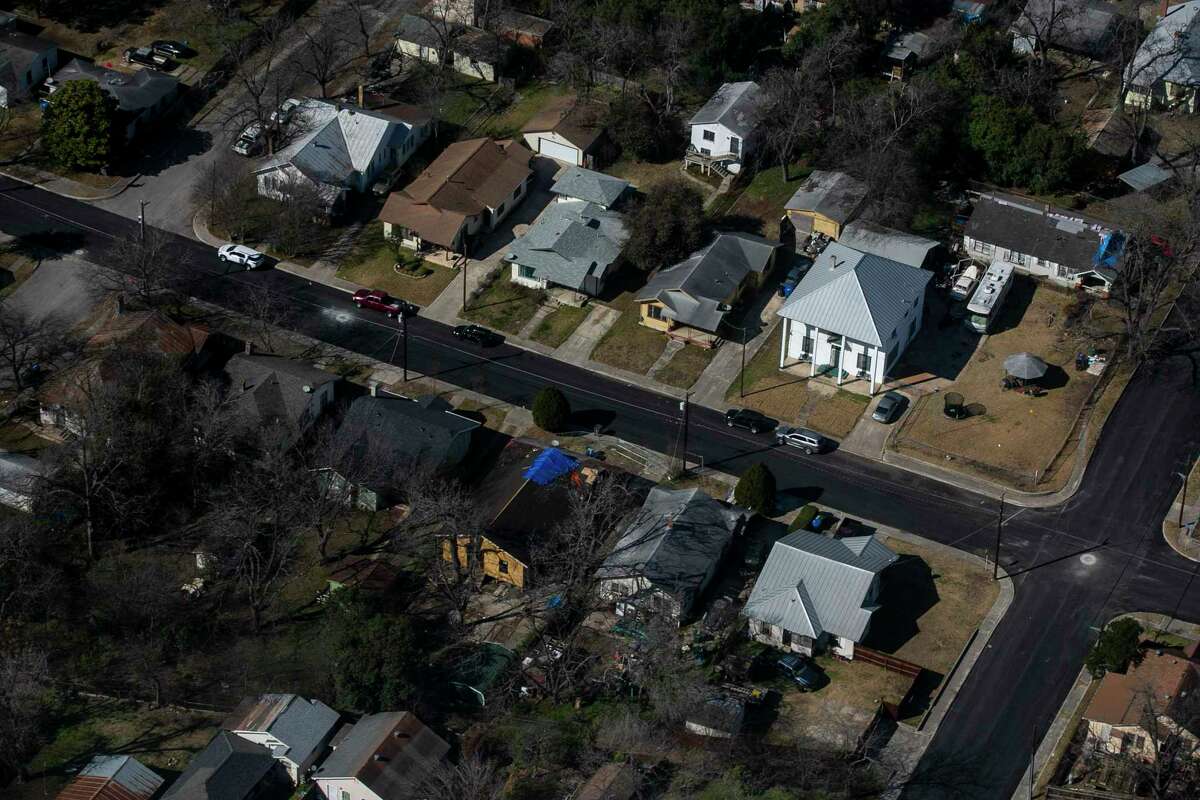

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief

68 Fun Things To Do In San Antonio Texas Tourscanner

Texas Selfie Museum Opens Selfie Worthy Spot In Downtown San Antonio

10 Things To Know Before Moving To San Antonio Tx

Property Tax For 65 Over Homeowners Who Volunteer May Be Lowered

Where To Live In San Antonio Texas Top 5 Far West Neighborhoods Youtube

New Houses San Antonio Texas D R Horton

Development Profile Weston Urban Names 32 Story Apartment Tower In Downtown San Antonio 300 Main San Antonio Heron

Car Rentals In San Antonio From 32 Day Search For Rental Cars On Kayak

Mercedes Benz Dealer Mercedes Benz Of San Antonio In San Antonio Mercedes Benz Gl Mercedes Benz Gl Class Mercedes Benz Dealer

Haunted Railroad Tracks In San Antonio

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

The Top 10 Reasons To Move To San Antonio Tx Home Money

The Best Places To Work In San Antonio

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Living In San Antonio 40 Things You Need To Know Before Moving Here Bhgre Homecity

Manage Your Fuel Tax Return With Global Multi Services Global Trucking Business Tax Return

Top 10 Reasons Not To Move To San Antonio Texas The Alamo Cities Pros And Cons Youtube